Why Lenders Choose LendExIn

End-to-end servicing for performing, non-performing, and default portfolios — built on accuracy, automation, and strict compliance.

Full-cycle servicing across performing, NPL, and default portfolios

Strong regulatory compliance foundation (RESPA, TILA, CFPB, FHA/VA/USDA, state-level)

Scalable operations for origination volume fluctuations

Automated workflows for posting, escrow, ARM, reporting, and delinquency

Transparent, audit-ready reporting for investors and regulators

Dedicated account managers and borrower-first support team

Cost-efficient servicing with zero compromise on accuracy

Our Mortgage Loan Servicing Capabilities

Part A — Performing Loan Servicing

Accurate, compliant servicing for healthy portfolios with a focus on borrower satisfaction.

Payment Processing

- Daily posting

- Lockbox management

- Suspense monitoring & reconciliation

Escrow Administration

- Tax & insurance disbursements

- Annual escrow analysis

- Notifications & adjustments

ARM Processing

- Index recalculations

- Margin/cap validation

- Timely rate-change notices

Payoff & Lien Release

- Payoff quotes

- Remittance

- Lien release coordination

SCRA Administration

- Active duty checks

- Interest-rate adjustments

- Documentation compliance

Investor & Agency Reporting

- FNMA/FHLMC/VA/FHA/USDA reporting

- Remittances, certifications, trial balances

Collateral Management

- Custody coordination

- Secure storage

- File transfers & imaging

Part B — Non-Performing Loan Servicing (NPL)

Reduce delinquency and recover value with structured, proactive workflows.

Early-Stage Delinquency Management

- Borrower notifications

- Late payment follow-ups

- Engagement to prevent roll rates

Collections & Borrower Outreach

- Phone, email, SMS, and mailed notices

- Right-party contact optimization

Repayment Plan & Hardship Reviews

- Hardship evaluations

- Documentation and compliance

- Custom repayment structures

Loss Forecasting & Risk Categorization

- Data-driven risk scoring

- Loss probability modeling

Part C — Default Servicing & Loss Mitigation

A complete framework aligned with federal, state, and investor requirements.

Loss Mitigation Programs

- Loan modifications

- Forbearance

- Repayment plans

- Partial claims (FHA)

- Short sale review

- Deed-in-lieu

Foreclosure Management

- Attorney coordination

- Notice management

- Timeline tracking

- Sale coordination

Bankruptcy Servicing

- POC filing

- Trustee coordination

- Stay monitoring

- Payment posting

Property Preservation

- Inspections

- Securing & repairs

- Vendor coordination

Part D — Investor, Compliance & Reporting

Audit-ready compliance and transparent portfolio insights.

Regulatory Compliance Oversight

Alignment with: RESPA, TILA, CFPB, State regs, Fannie Mae, Freddie Mac, FHA, VA, USDA

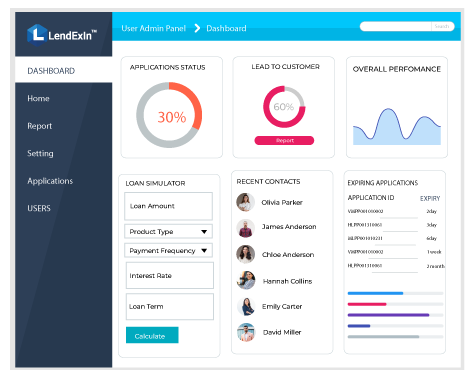

Portfolio Reporting & Analytics

- Delinquency summaries

- Escrow status

- Loss-mitigation pipeline

- Recovery performance

- Investor remittance reports

Quality Control & Audit Support

- Internal/external audits

- Servicing QC

- Annual certifications

Part E — Technology & Automation

Modern infrastructure that improves speed, accuracy, and portfolio performance.

AI-Enhanced Workflow Automation

- Predictive delinquency alerts

- Automated document routing

- Payment anomaly detection

Digital Borrower Portal

- Online payments

- Statements & escrow details

- Account updates & requests

Secure Document Management

- Digital collateral storage

- Imaging & indexing

- Full audit trails

Add-On Services

Optimize every part of your servicing operation.

Loan boarding & de-boarding

Document imaging & e-vaulting

QC & audit support

Borrower contact center

Portfolio surveillance & risk analytics

Year-end & tax statement preparation

Regulatory change management

Data migration/system conversions

REO & property disposition

Custom dashboards & reporting

What Our Clients Say

Get Started With LendExIn Mortgage Loan Servicing

LendExIn is the servicing partner built for lenders who prioritize accuracy, compliance, and borrower satisfaction.

Contact us today to schedule a consultation and strengthen your mortgage servicing operations.

Outsource Your Mortgage Loan Servicing to LendExIn

With deep expertise across the mortgage servicing ecosystem, LendExIn helps lenders streamline operations, reduce risk, and strengthen portfolio performance. Our end-to-end servicing model enables you to optimize every stage of the loan lifecycle — from performing accounts to delinquency, default, and loss mitigation.

Whether you’re scaling your mortgage operations, improving compliance, or seeking a more efficient servicing infrastructure, we provide the operational excellence and regulatory confidence you need.

Partner with LendExIn to achieve:

- Capitalization on modern automation, technology, and industry best practices

- Reduced operational friction and scalable servicing without added overhead

- Strong compliance alignment with federal, state, and investor guidelines

Let us handle the complexity — so your team can focus on growth and lending success.

Reach out with your mortgage servicing requirements today.

Let’s Request a Schedule For Free Consultation